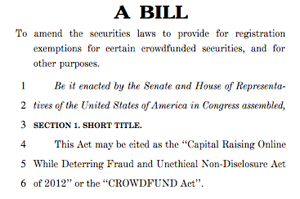

JOBS Act and CROWDFUND May Pass Today

Despite a pre-vote uproar by a minority group of democratic congress people, it appears as though the highly awaited JOBS Act has been fast tracked. This means the Senate voted to limit debate on the act and a final vote is expected at around 6 PM EST. If passed, Obama should quickly approve the bill effectively putting it into law.

Despite a pre-vote uproar by a minority group of democratic congress people, it appears as though the highly awaited JOBS Act has been fast tracked. This means the Senate voted to limit debate on the act and a final vote is expected at around 6 PM EST. If passed, Obama should quickly approve the bill effectively putting it into law.

It’s a big moment for entrepreneurs and a potentially massive disruption to the early-stage investing ecosystem. In addition to entrepreneurs being able to openly solicit investments from private investors, companies like AngelList, Kickstarter, and a number of others, will all be competing to capture a chunk of the new opportunity to serve as a platform for the investment transactions.

Another part of the quickly emerging crowd-funding ecosystem is the regulation of it. Opponents of the bill have criticized it for generating ripe new opportunities for fraud. That’s a problem that one organization, Crowdsourcing.org, hopes to solve through the company’s new Crowdfunding Accreditation for Platform Standards (CAPS) program. It has been set up prior to the JOBS Act being approved.

Trying to picture a world post-JOBS Act approval isn’t easy, yet I remember one comment I mentioned to Nivi & Naval of AngelList. I could see Dave McClure, who has been streaming the 500 Startups demo day for a while now, hopping on a telathon investment system. As Dave stands in front of rows of phone operators he yells at the camera, “Phones are ringing off the hook, investments are pouring in, and you too can have the opportunity to be part of the next Facebook or Google.”

A legal disclaimer sits as a footnote at the bottom of the screen that says something to the extent of, “Investing all of your money in startups is extremely risky and stupid. Any investments made through our program should be used as part of a portfolio diversification strategy. We are not responsible for the performance of any of the companies who speak on our show. Consult a financial advisor before making important financial decisions.”

Fortunately that disclosure will be in 8-point font and investments will still pour in. Perhaps this picture is a bit ridiculous, but ironically this bill will enable such types of programs to take place. I can guarantee there will be television shows just like this and I for one, will most definitely tune in. Aside from entertainment value, there’s an entirely different class of startups that have a significant opportunity: local small businesses.

Your favorite restaurant down the street may be running into some cash flow issues and now they can solicit an investment from you both in person and online (through Facebook and Twitter). The downside of this is that the average Joe may not understand the risk at stake which is why programs like CAPS (mentioned above) are so critical.

Yet the upside is massive: the marketplace becomes much more efficient and businesses that would typically die due to a lack of access to capital can continue to survive through the support of their customers. Best of all, the customers can make money back. Who doesn’t want to go out to a nice dinner and turn to their friend and say “I invested in this restaurant!”